After you reported a problem at work, things started to feel… different. You’re suddenly left out of important meetings. Your performance reviews have taken a nosedive without explanation. Or maybe your boss is micromanaging your every move. It’s easy to second-guess yourself and wonder if you’re just being paranoid. But these subtle shifts are often classic signs of illegal whistleblower retaliation. Employers rarely make it obvious. They use these tactics to make your life so difficult that you quit. If this sounds familiar, you need to understand your rights. This article will help you identify the red flags, document what’s happening, and know when it’s time to contact a whistleblower retaliation attorney to protect your career.

Key Takeaways

- Trust Your Gut on Subtle Retaliation: If you are treated differently after reporting misconduct—whether through a sudden bad review, demotion, or exclusion—it could be illegal retaliation. It doesn’t have to be as overt as getting fired.

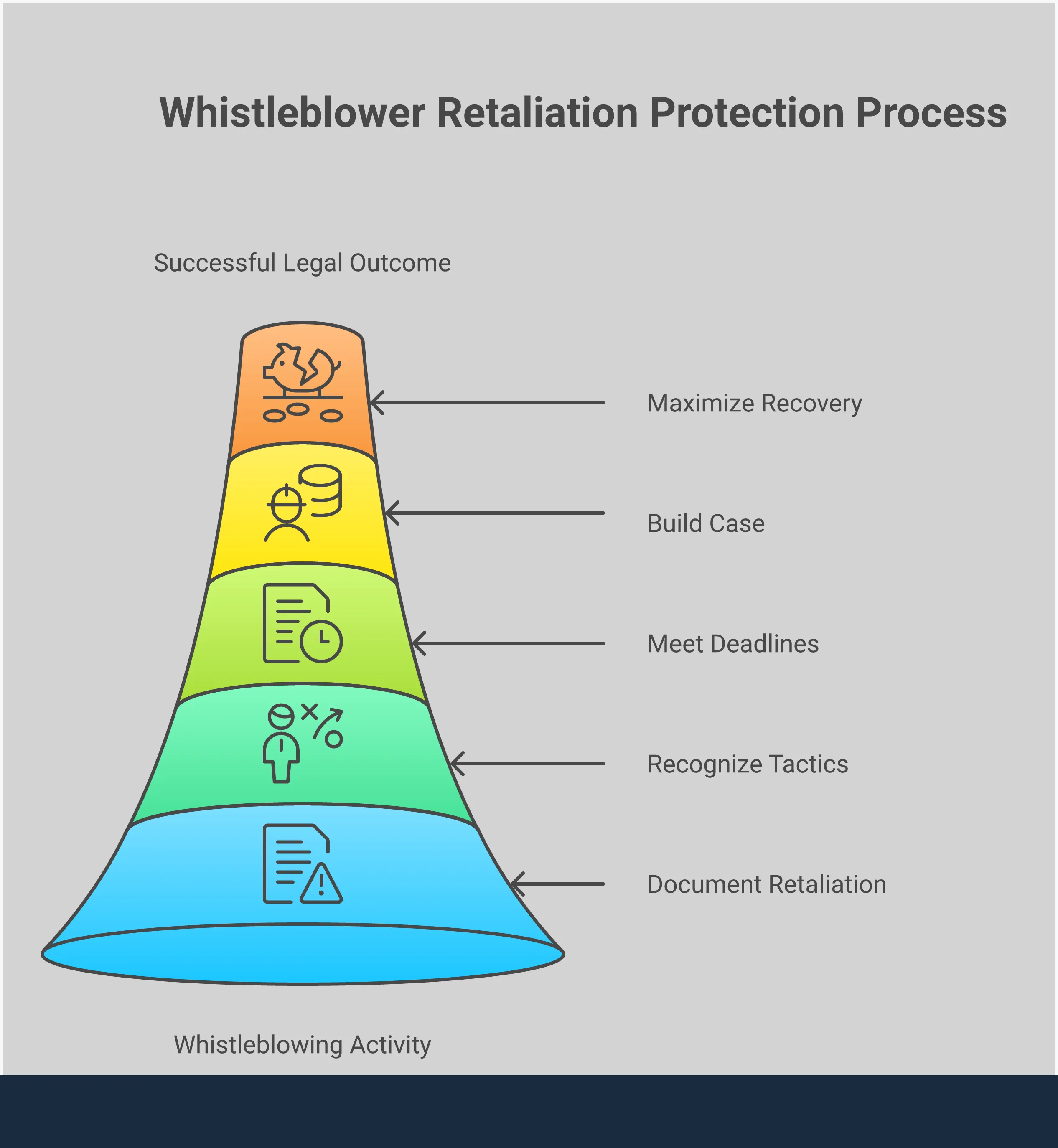

- Document Everything and Act Quickly: Keep a detailed log of all incidents, save relevant emails and messages, and contact an attorney as soon as you suspect retaliation. Strict legal deadlines mean that waiting can risk your right to file a claim.

- You Have Powerful Legal Backing: California laws are designed to protect whistleblowers, and a successful lawsuit can help you recover lost wages, compensation for emotional distress, and even have your employer pay your attorney’s fees.

What is Whistleblower Retaliation?

Speaking up about something wrong at work takes courage. When you do the right thing, you expect to be heard, not punished. Unfortunately, some employers react by penalizing the employee who raised the alarm. This is called whistleblower retaliation, and it’s illegal. It occurs when your employer takes any negative action against you because you reported conduct you reasonably believed was against the law or a regulation. This protection applies whether you reported the issue internally to a manager or HR, or externally to a government agency. The entire point of whistleblowing laws is to protect employees who act in the public’s interest, ensuring they can report misconduct without fear of losing their job or facing other punishments.

Defining a Protected Activity

A “protected activity” is the specific action you take that shields you from retaliation. Simply put, it’s the act of reporting illegal, fraudulent, or unethical behavior. This isn’t limited to grand-scale corporate fraud you see in movies. It can include reporting safety violations, financial mismanagement, or any form of discrimination. The key is that you are reporting a violation of a law, rule, or regulation. Complaining about a manager’s personality or general company policy usually doesn’t count. However, reporting that the same manager is breaking wage and hour laws is a protected activity.

Examples of Workplace Misconduct

You might be wondering if the issue you’ve seen qualifies as misconduct. Whistleblowers often report a wide range of violations. This can include things like an employer illegally dumping waste, committing financial fraud, ignoring health and safety codes, or refusing to pay required overtime. It also covers reporting a hostile work environment caused by harassment or discrimination. If you witness your company breaking the law or creating an unsafe or illegal environment for its employees, reporting it is likely a protected activity.

What Does Retaliation Look Like?

Retaliation isn’t always as obvious as being fired on the spot. Employers often use subtle tactics to punish an employee, hoping to make them so uncomfortable that they quit. As a victim of retaliation at work, you might experience a sudden demotion, a pay cut, or a transfer to a less desirable location or shift. Other signs include being excluded from important meetings, receiving an unexpectedly negative performance review, being stripped of your key job duties, or being reassigned to a role with no real purpose. Any negative change to the terms and conditions of your employment that happens after you report misconduct could be a form of retaliation.

Know Your Legal Rights

California has strong laws that protect employees from retaliation. It’s important to know that you are protected even if your report turns out to be incorrect, as long as you had a reasonable belief that what you were reporting was true. You don’t have to be an expert on the law; you just have to act in good faith. These protections are in place to encourage people to speak up without fear. If you are punished for doing so, it may be considered a form of wrongful termination or another adverse employment action, and you have the right to hold your employer accountable.

The Real Cost of Retaliation

When you speak out against illegal or unethical behavior at work, the consequences can extend far beyond your job description. Retaliation isn’t just a professional setback; it’s a personal attack that can affect your health, finances, and future career prospects. Understanding the true cost is the first step toward protecting yourself and fighting back.

The Toll on Your Mental Health

Speaking up takes courage, but the aftermath can be incredibly isolating. The stress of facing retaliation often leads to anxiety, depression, and feeling overwhelmed. It’s a heavy burden to carry, and these feelings are a normal response to an unjust situation. The psychological impacts of whistleblowing are significant and can affect your well-being long after you’ve left the office. Recognizing this emotional toll is a real and valid part of the experience is the first step. Your mental health is just as important as your career and deserves protection.

The Impact on Your Career

The most obvious fear is getting fired, but retaliation isn’t always that direct. It can be subtle: being passed over for a promotion, getting sudden negative performance reviews, or being excluded from important meetings. Some employers create a hostile work environment to push you out without an official termination. These actions can stall your career and make you question your future. Remember, you have rights. State and federal laws are designed to protect you from these retaliatory actions, whether they are overt or subtle.

The Financial Strain

When your career is targeted, your finances are next. A sudden job loss means an immediate end to your paycheck, creating immense pressure to cover bills. Even a demotion or a cut in hours can seriously impact your income. The financial strain isn’t just about lost wages; it can include therapy costs or medical bills for stress-related health issues. Fortunately, the legal system recognizes these hardships. When you file a claim, you can seek compensation for lost income, benefits, and the emotional distress you’ve endured.

Lasting Career Consequences

One of the biggest anxieties is the fear of being blacklisted. Will future employers see you as a troublemaker? It’s a valid concern, but it’s not the whole story. The law bans employers from retaliating against you, which includes damaging your professional reputation. While the road can be challenging, being a whistleblower is an act of integrity that many future employers will respect. With the right legal strategy, you can protect your career. Your professional journey doesn’t have to end because you stood up for what’s right.

When Should You Call an Attorney?

Deciding to contact a lawyer can feel like a huge step, but you don’t have to be certain you have a case to ask for guidance. In fact, the sooner you understand your rights, the better you can protect yourself. If your gut is telling you that something is wrong at work after you reported misconduct, it’s probably time to listen. An attorney can help you make sense of the situation and figure out the best path forward. Waiting too long can mean losing out on important evidence or even missing the window to file a claim altogether.

Red Flags: Signs of Workplace Retaliation

Retaliation isn’t always as dramatic as being fired on the spot. Often, it’s more subtle. You might notice a sudden shift in how you’re treated after speaking up. Are you suddenly getting negative performance reviews after a history of positive feedback? Are you being left out of meetings or projects you should be a part of? Maybe your job duties have changed without explanation, or you’re being micromanaged. These actions can be a calculated effort to make your work life so uncomfortable that you quit. If you’re experiencing this kind of treatment, it could be a sign of illegal retaliation at work.

Don’t Miss Your Legal Deadlines

One of the most critical reasons to act quickly is that the law sets strict deadlines, known as statutes of limitations, for filing a claim. These deadlines vary depending on the type of claim and the agency you need to file with. For example, some claims must be filed within months, not years. If you miss the deadline, you could lose your right to seek justice forever. Acting promptly ensures you meet these legal requirements and helps preserve crucial evidence, like emails and witness memories, while it’s still fresh. An attorney can help you identify the specific deadlines that apply to your situation.

What to Document and Why It Matters

If you suspect you’re being retaliated against, documentation is your best friend. Start keeping a detailed log of every incident. For each entry, write down the date, time, location, and who was involved. Describe exactly what happened and what was said. Save any relevant emails, text messages, performance reviews, or internal communications. If your pay or hours have been changed, keep records of that, too. This timeline creates a clear record of events that can be incredibly powerful in proving your case. This evidence is essential for any potential whistleblower claim.

Your First Consultation: What to Expect

Reaching out to a lawyer for the first time can be intimidating, but it’s simply a conversation. A consultation is your chance to tell your story to a professional who understands employment law. You can bring the documentation you’ve gathered and ask all your questions. The attorney will listen, help you understand your legal rights, and explain your potential options. This initial meeting doesn’t obligate you to file a lawsuit. It’s about getting clarity and expert advice so you can make an informed decision. Think of it as the first step in taking back control of your situation.

How an Attorney Protects You

Facing retaliation after speaking up at work can feel incredibly isolating. You might feel like it’s you against a powerful company, and the legal system can seem like a maze. This is where an experienced employment attorney steps in. They don’t just offer legal advice; they become your dedicated partner, handling the complexities of your case so you can focus on moving forward. From the moment you hire them, their job is to shield you from pressure, manage the details, and build the strongest possible case on your behalf. They level the playing field, ensuring your employer takes your claim seriously and that your rights are vigorously defended every step of the way.

Your Advocate in the Legal System

Navigating the legal landscape alone is a daunting task. Whistleblower laws at the federal and state levels are complex, and knowing which path to take is critical. An attorney acts as your guide and your voice, ensuring your story is heard correctly. They understand the nuances of laws designed to protect employees who report misconduct and can determine the best strategy for your specific situation. Instead of you having to face your employer’s legal team alone, your lawyer stands with you, advocating for your rights and making sure you are protected from further victim of retaliation at work.

Handling the Paperwork

A retaliation claim involves much more than just telling your story. There are strict procedures and deadlines for filing complaints with government agencies and courts. Missing a deadline or filling out a form incorrectly can jeopardize your entire case. An attorney manages all of this for you. They handle the administrative burdens, from drafting official complaints to filing motions and responding to your employer’s lawyers. This meticulous attention to detail ensures every step is completed correctly and on time, preventing simple procedural errors from derailing your pursuit of justice.

Gathering the Proof You Need

Proving retaliation requires solid evidence that connects your protected activity to your employer’s negative actions. But where do you even start? An attorney knows exactly what to look for, such as emails, performance reviews, witness testimony, and company records. They can use legal tools like subpoenas to obtain evidence your employer might not want to share. This process can be emotionally taxing, but your lawyer handles it objectively, gathering the facts needed to build a compelling narrative while you focus on your well-being. This is especially crucial in cases of wrongful termination.

Building a Strong Case

Once the evidence is collected, your attorney pieces it all together to construct a powerful legal argument. Their goal is to clearly show a judge, jury, or your employer’s legal team how your actions as a whistleblower led directly to the retaliation you experienced. This involves more than just presenting facts; it’s about telling a persuasive story backed by law. They will also calculate the full extent of your damages, including lost wages, benefits, and compensation for the emotional distress you’ve endured, ensuring your claim reflects everything you’ve lost.

Negotiating with Your Employer

Many employment disputes are resolved through negotiation before ever reaching a courtroom. Having a skilled attorney in your corner during this process is a major advantage. They can communicate with your employer’s representatives on your behalf, removing the stress and emotion from the conversation. Because they have built a strong case, they can negotiate from a position of strength to secure a fair settlement that compensates you for the harm you’ve suffered. Your lawyer’s experience with whistleblowing cases gives them insight into what a fair outcome looks like and the strategies to achieve it.

The Laws That Protect Whistleblowers

When you’re thinking about reporting misconduct at work, one of your biggest fears might be what happens next. It’s completely normal to worry about your job, your reputation, and your future. The good news is that you’re not alone in this, and there are powerful laws designed specifically to protect you. Both federal and state governments have established legal shields for employees who have the courage to speak out against illegal, unsafe, or unethical activities.

These laws exist because regulators understand that employees are often the first to witness wrongdoing. By protecting you from retaliation, the legal system encourages people to come forward and hold companies accountable. Understanding these protections is the first step toward feeling secure in your decision to do the right thing. Think of these laws as your armor; they ensure that your employer can’t legally punish you for being a whistleblower.

Federal Laws on Your Side

On a national level, several key laws offer a strong foundation of protection for whistleblowers. You might have heard of laws like the Whistleblower Protection Act, which primarily covers federal employees, or the Sarbanes-Oxley Act, which protects employees of publicly traded companies who report financial fraud. These federal statutes provide clear safeguards against retaliation and, in some cases, even offer incentives for reporting misconduct. They send a clear message to employers across the country: punishing an employee for exposing illegal activity is against the law. While these laws cover specific situations, they are part of a larger legal framework that recognizes the importance of protecting those who speak up.

California’s Specific Protections

California offers some of the strongest whistleblower protections in the country, giving you an extra layer of security. The most important law to know is California Labor Code 1102.5. In simple terms, this law makes it illegal for your employer to retaliate against you for reporting information you reasonably believe is a violation of a local, state, or federal rule. The key phrase here is “reasonably believe.” You don’t have to be a legal expert or have absolute proof that your employer broke the law. As long as you have a genuine and reasonable belief that something is wrong, you are protected when you report it. This is a critical safeguard against workplace retaliation.

Rules for Different Industries

Depending on your profession, you may have access to even more specific protections. Industries like healthcare, finance, education, and government often have their own unique whistleblower laws. For example, healthcare workers who report patient safety violations or fraudulent billing are covered by specific regulations. Similarly, government contractors have distinct channels and protections for reporting waste or fraud. These industry-specific rules can sometimes provide additional safeguards, offer different reporting procedures, and even extend the deadlines for filing a claim. An experienced attorney can help you understand the particular laws that apply to your field and ensure you follow the correct steps to protect yourself.

Your Right to Confidentiality

While the law is on your side, it’s also wise to be strategic about how you report misconduct. To protect yourself, it’s best to engage in whistleblowing activities on your own time and with your own resources. This means using your personal phone, computer, and email account—not company property—to communicate or gather information. When possible, use secure communication methods to maintain confidentiality. An attorney can give you specific advice on how to document and report wrongdoing in a way that is both effective and safe. Taking these careful steps can help shield you from accusations of misusing company resources and strengthen your position if you face whistleblower retaliation.

What to Expect from the Legal Process

The legal system can feel like a maze, but knowing the map makes the journey much clearer. When you decide to pursue a whistleblower retaliation claim, the process generally follows a few key stages. While every case is unique, understanding these steps can help you feel more in control. Your attorney will be your guide, handling the complexities so you can focus on moving forward. From filing the initial paperwork to negotiating a fair outcome, each phase is a deliberate step toward holding your employer accountable and securing the justice you deserve.

The First Steps: Filing a Claim

Before you can file a lawsuit, there are specific procedural steps you must take. A common mistake is failing to follow the correct procedure for filing a claim, which can jeopardize your case from the start. In California, you typically need to notify the California Labor and Workplace Development Agency and your employer before you can sue. This initial filing is critical. An experienced attorney ensures all paperwork is submitted correctly and on time, establishing a solid foundation for your case and protecting your right to seek justice for the workplace retaliation you experienced.

Reaching a Settlement

Many employment disputes are resolved before ever seeing the inside of a courtroom. A settlement is a confidential agreement between you and your employer to resolve the issue, and it’s often the most efficient path forward. Your attorney will assess all your options and potential remedies to build a strong negotiating position. They will then work to secure a settlement that fairly compensates you for your losses. This can include lost wages, benefits, and other damages. The goal is to reach a resolution that allows you to move on with your life without the stress and uncertainty of a prolonged court battle.

What Happens if Your Case Goes to Court

If your employer is unwilling to offer a fair settlement, your attorney will be prepared to take your case to court. This process involves gathering evidence, interviewing witnesses, and presenting your case before a judge or jury. While it requires more time, going to court can result in a significant award. If you win, you may be entitled to compensation for the emotional distress the retaliation caused, and in some cases, a court may award punitive damages. These damages are designed to punish the employer for their unlawful conduct and deter them from retaliating against other employees in the future.

How Long Will It Take?

It’s natural to wonder how long the process will take. The timeline for a whistleblower case can vary widely. In California, you generally have three years to sue for retaliation, but you must first file a claim with the appropriate state agency. Some cases settle within a few months, while others that proceed to trial can take a year or more. The complexity of your case and the willingness of your employer to negotiate will both play a role. Your attorney will manage the deadlines and keep you informed at every stage, ensuring your whistleblower claim is handled efficiently.

What Can You Recover in a Lawsuit?

If you’ve faced retaliation for doing the right thing, you might be wondering what you can actually gain by filing a lawsuit. It’s about more than just getting justice; it’s about making you whole again. The law provides several ways to compensate you for the harm you’ve suffered, both financially and emotionally. When an employer retaliates against a whistleblower, they can be held responsible for the damage they cause.

The goal of legal remedies is twofold: to restore you to the position you would have been in if the retaliation had never happened and to hold the employer accountable for their illegal actions. This means looking at the full picture of your losses. Depending on the specifics of your case, this can include everything from recovering lost income and benefits to compensation for the emotional distress you’ve endured. In situations where an employer’s conduct was especially harmful, they may even be ordered to pay additional damages as a form of punishment. An experienced attorney can help you understand what you may be entitled to and will fight to secure the full range of compensation you deserve as a victim of retaliation at work. They will assess every aspect of your situation to build a strong case for the maximum possible recovery.

Recovering Lost Wages and Financial Losses

One of the most immediate impacts of retaliation is financial. If you were fired, demoted, or had your hours cut, you’ve lost income. The primary remedy for this is “back pay,” which is the salary, bonuses, and benefits you would have earned from the date of the retaliation up to the resolution of your case. This isn’t just about your base salary; it includes lost raises, commissions, and the value of benefits like health insurance and retirement contributions. You can also be compensated for other financial losses you incurred as a direct result of the retaliation, such as the costs of searching for a new job. These wage & hour claims are designed to repair the direct financial hole left by your employer’s actions.

Compensation for Emotional Distress

Retaliation doesn’t just hurt your wallet; it takes a significant emotional toll. Facing a hostile work environment, losing your job, and fighting for your rights can cause immense stress, anxiety, and mental anguish. The legal system recognizes this harm. You can be awarded damages for the emotional distress the retaliation caused, including compensation for mental suffering, sleepless nights, or any physical symptoms that resulted from the stress. While no amount of money can erase the experience, this compensation acknowledges the real and painful impact the employer’s actions had on your well-being and your life outside of the office. This is a key component in cases involving a hostile work environment.

Punitive Damages: Holding Employers Accountable

Sometimes, an employer’s retaliation is particularly malicious or reckless. In these cases, the court may award punitive damages. Unlike other forms of compensation that are meant to make you whole, punitive damages are designed to punish the employer and send a clear message that their behavior is unacceptable. These damages are not awarded in every case. They are reserved for situations where the employer’s conduct was especially egregious, intended to deter them and other companies from engaging in similar illegal retaliation in the future. Pursuing a whistleblowing case can help ensure employers think twice before punishing someone for speaking up.

Getting Your Job Back

For some people, the ideal outcome is to return to the job they lost. This remedy is called “reinstatement.” If you were wrongfully terminated, the court can order your employer to give you your position back, along with the seniority and benefits you would have had if you were never fired. Of course, returning to a company that retaliated against you isn’t always practical or desirable, and many people choose to move on. However, reinstatement remains a powerful legal option for those who want to reclaim their career path after a wrongful termination attorney in California proves their case. It’s your right to pursue it if that’s the outcome you want.

Making Your Employer Pay Legal Fees

The thought of paying for a lawyer can be intimidating, especially when you’ve just lost your income. Fortunately, whistleblower protection laws were written with this in mind. If you win your case, your employer can be ordered to pay your reasonable attorney’s fees and legal costs. This provision is crucial because it allows employees to stand up for their rights without having to bear the financial burden of litigation. It levels the playing field, ensuring you can afford high-quality legal representation to fight a company with far greater resources. This means you can partner with our firm to seek justice without the fear of being buried in legal bills.

Taking Care of Yourself During the Process

Going through a whistleblower retaliation case is incredibly demanding, not just legally, but emotionally and mentally. While your legal team focuses on the details of your case, it’s essential that you prioritize your own well-being. The stress of uncertainty, financial strain, and professional disruption can take a significant toll. Protecting your mental health is not a luxury—it’s a necessary part of staying resilient throughout this process. Think of it as building the personal strength you need to see this through to the end.

Finding Professional Support

You don’t have to carry the emotional weight of this experience by yourself. Speaking with a therapist or counselor can provide a confidential space to process the anger, anxiety, and sense of betrayal that often accompany a retaliation claim. A mental health professional can offer coping strategies tailored to your situation, helping you manage the day-to-day stress of the legal battle. Remember that you are not alone, and there are many resources available to help you cope with the emotional impact. Seeking this kind of support is a sign of strength and a proactive step toward protecting your mental health for the long run.

Healthy Ways to Cope with Stress

The mental anguish and suffering caused by retaliation are very real, so much so that the law allows you to seek compensation for emotional distress. While your case is ongoing, finding healthy outlets for this stress is crucial. This looks different for everyone. It might mean committing to a daily walk, returning to a hobby you once loved, or practicing mindfulness or meditation. The goal is to find activities that allow your mind to rest and recharge. Consistently making time for these practices can help regulate your nervous system and give you a greater sense of control when everything else feels chaotic.

Leaning on Your Support System

When you’re under immense pressure, it’s easy to withdraw from the people who care about you most. However, your friends and family can be your greatest allies. The fear of instability and emotional distress can strain relationships and lead to isolation, so make a conscious effort to stay connected. Be open with trusted loved ones about what you’re going through and don’t be afraid to tell them what you need, whether it’s a listening ear or a distraction from the case. Building a strong personal support system gives you a foundation of stability and reminds you that you have a team of people in your corner.

Finding Balance Amid the Chaos

It’s easy to get so deep in the trenches of a legal case that it consumes your every waking thought. To avoid burnout, you have to find balance. Make a point to schedule time for activities that have nothing to do with your case or your former job. Reconnect with the parts of your identity that bring you joy and confidence. Whether it’s cooking, spending time in nature, or getting lost in a good book, these moments of normalcy are vital. Setting boundaries around how much time you spend thinking or talking about the case will help you preserve your energy and maintain perspective for the journey ahead.

How to Choose the Right Whistleblower Attorney

Finding the right attorney can feel like a monumental task, especially when you’re already dealing with the stress of workplace retaliation. But the right legal partner can make all the difference. A good whistleblower attorney doesn’t just know the law; they understand what you’re going through and can guide you through the process with confidence. When you’re ready to find representation, focus on a few key areas to ensure you’re choosing an advocate who is truly equipped to fight for you.

Look for Relevant Experience

Not all employment lawyers are the same. Whistleblower law is a highly specialized field with its own set of complex federal and state rules. You need someone who has specific, hands-on experience with cases like yours. An attorney who focuses on whistleblower claims will understand the unique challenges of proving retaliation and will be familiar with the tactics employers use to defend themselves. They should have a deep knowledge of laws like the Sarbanes-Oxley Act or the California Whistleblower Protection Act, depending on your situation. This isn’t the time for a generalist; you need a specialist.

Check Their Track Record

Experience is one thing, but a history of success is another. Before you commit, do a little research on the attorney and their firm. Look for client testimonials, case results, and reviews that speak to their ability to deliver for their clients. A firm that is proud of its work will often share its successes. This track record demonstrates that they not only take on these cases but that they know how to win them. It shows they have the resources and the determination to see a complex retaliation case through to a positive resolution, whether through a settlement or in court.

Understand How They Get Paid

The cost of legal representation is a valid concern for anyone, especially if your income has been affected by retaliation. The good news is that most reputable whistleblower attorneys work on a contingency fee basis. This means you don’t pay any attorney’s fees unless they win your case. The fee is typically a percentage of your settlement or award. Be sure to ask for a clear explanation of this structure during your initial consultation. You should also ask about other potential costs, like filing fees or expert witness expenses, so there are no surprises down the road.

Find a Lawyer Who Listens

This process is deeply personal, and you’ll be sharing sensitive details about your career and your life. It’s crucial to find an attorney who makes you feel comfortable and heard. A good lawyer will take the time to listen to your story, understand your goals, and answer your questions without using confusing legal jargon. You should feel like a partner in your own case, not just another file on their desk. Trust your gut. If an attorney seems dismissive or too busy to give you their full attention, they probably aren’t the right fit for you or our firm.

Key Questions to Ask in a Consultation

Your initial consultation is your opportunity to interview the attorney. Don’t be afraid to ask direct questions to make sure they are the right choice. Come prepared with a list to help guide the conversation.

Here are a few to get you started:

- How many whistleblower cases have you handled specifically?

- What is your strategy for a case like mine?

- What are the potential outcomes, both good and bad?

- How will you communicate with me, and how often can I expect updates?

- Who will be the primary person working on my case?

Their answers will give you valuable insight into their experience, communication style, and overall approach to employment law.

The “Retaliation Timeline”: How to Spot Illegal Treatment

Retaliation rarely happens immediately. It often manifests as a “slow burn” after you’ve reported harassment or illegal activity. Look for these signs:

The Sudden Performance Drop: You’ve had 5-star reviews for years, but weeks after reporting a safety violation, you receive a “Performance Improvement Plan” (PIP).

Excluded from Meetings: You are suddenly left out of emails or projects that are central to your role.

San Diego Specific Protections: If you are a San Diego employee reporting corporate fraud or labor violations, you are protected under Labor Code 1102.5. Employers who retaliate face stiff penalties, including up to $10,000 per violation.

Related Articles

- Canoga Park Employment Lawyer – Bluestone Law

- California Whistleblower Lawyer | Protect Employee Rights

- Whistleblower lawyer california – Bluestone Law

- Whistleblower Attorney in California | Bluestone Law

Frequently Asked Questions

What if I reported something I thought was illegal, but it turns out I was mistaken? Am I still protected? Yes, in most cases, you are. California law protects you as long as you had a “reasonable belief” that you were reporting a violation of the law. You don’t have to be a legal expert or have undeniable proof. The focus is on your good-faith effort to report what you genuinely believed was wrongdoing. The law is designed to encourage people to speak up without the fear of being punished for a mistake.

My boss didn’t fire me, but my job has become miserable since I spoke up. Does that count as retaliation? Absolutely. Retaliation is any negative action your employer takes that would deter a reasonable employee from reporting misconduct. It doesn’t have to be as obvious as a termination. It can include being demoted, having your pay cut, being excluded from important meetings, receiving a sudden negative performance review, or being transferred to a less desirable role. These more subtle actions are often a deliberate attempt to make you so uncomfortable that you quit.

How can I possibly afford a lawyer if I’ve lost my job or had my pay cut? This is a very common and understandable concern. Most reputable employment attorneys who represent employees, including our firm, work on a contingency fee basis. This means you don’t pay any attorney’s fees upfront. Instead, the lawyer’s fee is a percentage of the money they recover for you through a settlement or court award. If you don’t win your case, you don’t owe any attorney’s fees. This structure allows you to pursue justice without having to worry about the cost.

Will suing my former company make it impossible for me to get another job in my field? It’s natural to worry about your future career prospects. While the fear of being seen as a “troublemaker” is real, many employers value integrity and courage. Furthermore, the law prohibits your former employer from retaliating against you by bad-mouthing you to potential new employers. A skilled attorney can also help you develop a strategy for how to address your experience in future job interviews, focusing on your commitment to ethical conduct.

What is the single most important thing I should do if I suspect I’m facing retaliation? Document everything. Start a private log, on your own time and using your own device, not company property. For every incident, write down the date, time, what happened, what was said, and who was present. Save any relevant emails, text messages, or performance reviews to a personal account or device. This detailed timeline is one of the most powerful tools you will have to prove the connection between your report and your employer’s negative actions.