Losing your job can leave you feeling powerless, but you have more leverage than you might think when it comes to your exit terms. A severance package isn’t a gift; it’s a business transaction. Your employer wants a smooth separation and to protect themselves from potential legal action. This gives you an opportunity to advocate for yourself. The key is to approach the discussion professionally and strategically. Knowing how to negotiate a severance package transforms the process from an emotional challenge into a clear-headed business deal. We’ll show you how to build your case, present a strong counter-offer, and secure terms that reflect your contributions and support your transition to what’s next.

Key Takeaways

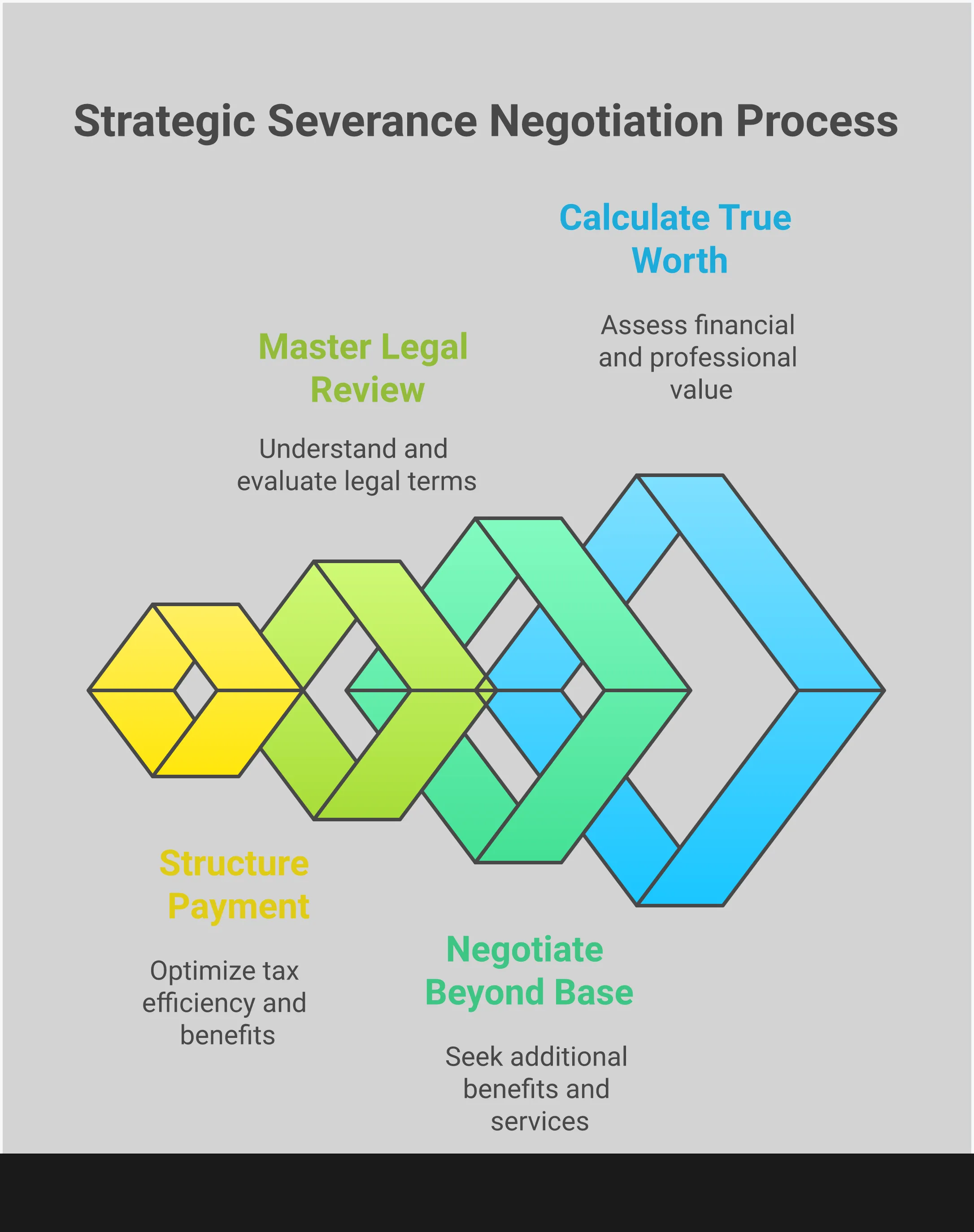

- Build Your Case for a Better Offer: Don’t accept the first proposal without doing your homework. Gather your employment contract, performance reviews, and pay stubs to calculate what you’re truly owed, including unused vacation time and potential bonuses, to create a strong, fact-based counter-offer.

- Negotiate Beyond the Final Paycheck: A strong severance package includes more than just cash. Consider asking for extended health insurance coverage, career transition services, a positive letter of reference, or the removal of restrictive non-compete clauses to support your next steps.

- Review the Fine Print Before You Sign: A severance agreement is a legal contract where you release your right to sue your former employer. Use your legally mandated review period to read every clause carefully, and consult an employment lawyer to ensure you fully understand the terms and are being fairly compensated for the rights you are giving up.

What is a Severance Package?

When your time with a company comes to an end, you might be offered a severance package. Think of it as a formal agreement between you and your former employer that outlines the pay and benefits you’ll receive after your last day. It’s more than just a final paycheck; it’s a contract that includes extra compensation in exchange for you agreeing to certain terms, like keeping company information private.

While it can feel like a take-it-or-leave-it situation, a severance package is often the starting point for a conversation. Understanding what’s typically included, what your rights are, and when you can negotiate is the first step toward ensuring you leave your job on the best possible terms. It’s about securing a financial cushion and other benefits to support you as you figure out what’s next.

What to Expect in a Standard Package

A standard severance package usually includes more than just pay. The core component is severance pay, which is often calculated as one to three weeks of your salary for every year you worked at the company. Beyond that, a typical package might include payment for any unused vacation or sick days you’ve accrued. Many employers also offer to continue your health insurance coverage for a set period, which can be a huge relief. You should also look for information about your retirement savings or stock options and whether the company provides outplacement services, like career coaching or resume help, to assist in your job search.

Know Your Legal Rights in California

It’s important to know that, in most cases, federal law doesn’t require companies to offer severance pay. It’s typically a benefit offered by the employer as part of a mutual agreement. However, you do have rights in this process. If you are over 40, federal law gives you at least 21 days to review a severance agreement (or 45 days if you’re part of a group layoff). This review period is crucial. It gives you time to fully understand the terms and decide if they are fair. You are not obligated to accept the first offer, and you can always propose changes to any part of the package, especially if you believe you may have grounds for a wrongful termination claim.

Know When You Can Negotiate

Many people don’t realize that severance packages are almost always negotiable. Your former employer likely expects you to come back with a counter-offer, and they often have room to improve their initial proposal. In fact, some sources suggest that employees who negotiate can receive significantly more than what was first offered. Don’t underestimate your leverage. Even if you don’t have a strong legal claim, companies are often willing to negotiate to avoid the time and expense of potential legal disputes. The initial offer is just that—an offer. You have the power to ask for more, whether that’s a higher payout, longer benefits, or better non-financial terms.

Assess Your Package’s Value

Before you can effectively negotiate your severance package, you need a clear understanding of what it’s worth and what you deserve. This isn’t about guesswork; it’s about doing your homework to build a solid, fact-based case for yourself. Taking the time to evaluate the initial offer against your employment history, earned benefits, and industry standards will give you the confidence and leverage you need to ask for more. Think of this as gathering the evidence that will support your counter-offer. A well-prepared negotiation starts with knowing the numbers and understanding the full scope of what’s on the table. This initial assessment is your foundation for a successful conversation, ensuring you don’t leave anything you’re entitled to behind.

Review Your Employment History

First things first: gather all your documents. This includes your original offer letter, any employment contracts or agreements you signed, your most recent performance reviews, and, of course, the official layoff notice. Having a complete record of your employment terms, salary history, and contributions to the company is essential. Make sure you have everything in writing. This paper trail establishes a clear baseline of your employment terms and any specific promises the company made, which will be invaluable as you prepare to negotiate.

Calculate What You’re Owed

Now it’s time to do some math. A common starting point for severance is one to two weeks of pay for every year you worked for the company. But don’t stop there. In California, employers are required to pay out any accrued, unused vacation time upon termination. Make sure this is included in your package. You should also account for any earned bonuses or commissions. Calculating these figures gives you a concrete number to work with and ensures you’re not leaving any of your earned wage and hour claims on the table.

Research Industry Standards

What’s considered a “standard” severance package can vary widely depending on your industry, role, and the size of the company. Do some research to see what’s typical. You can check professional networking sites, talk to former colleagues, or look at anonymous forums. Companies often have room to negotiate, especially if they want to avoid potential legal issues or negative publicity. Understanding what’s standard in your field gives you a powerful benchmark and helps you frame your requests as reasonable and fair. This knowledge is especially critical if you suspect your termination was unlawful, as it can strengthen your position in a wrongful termination scenario.

Identify What You Can Negotiate

A severance package is more than just a final paycheck. There are many components you can negotiate beyond the base pay. Think about what’s most important for your transition. Would an extension of your health insurance coverage be more valuable than extra cash? Could you benefit from outplacement services or career coaching to help you find your next role? Other negotiable items include stock options, pro-rated bonuses, and a mutually agreed-upon public statement about your departure. Decide on your priorities before you start the conversation.

Key Items to Negotiate

When your employer presents you with a severance agreement, it’s easy to focus only on the final paycheck. But a strong severance package is more than just cash. It can include continued benefits, stock options, and support for your next career move. Many people don’t realize the first offer is just a starting point. Understanding which components are on the table is the first step toward securing an agreement that truly supports your transition. Let’s walk through the key areas where you have room to negotiate.

Base Severance Pay

This is the most obvious part of the package, but the amount is often flexible. A common starting point for severance pay is one to two weeks of salary for every year you’ve worked for the company. If the initial offer feels low based on your tenure and contributions, you can absolutely ask for more. Frame your request around your years of service, your role in the company, and industry standards. Don’t assume the first number is final. This is your opportunity to ensure you have a financial cushion while you search for your next role, which is especially critical if you suspect a wrongful termination.

Health Insurance Coverage

Losing your job often means losing your health insurance, which can be a major source of stress. You’ll likely be offered COBRA, which allows you to keep your plan but requires you to pay the full premium yourself. This can be incredibly expensive. A great negotiation point is to ask your former employer to pay for your COBRA premiums for a few months as part of the severance package. This provides a seamless continuation of coverage for you and your family, giving you one less thing to worry about. This is a valuable, non-taxable benefit that can make a huge difference during your transition period.

Stock Options and Bonuses

If you have stock options or were anticipating a bonus, don’t leave that money on the table. Review your stock option agreement to understand your vesting schedule. If you’re close to a vesting date, you can negotiate for an accelerated vesting of your options so you don’t lose them. Similarly, if you were let go shortly before bonuses were scheduled to be paid out, you should ask for a pro-rated portion of your expected bonus. You earned it through your hard work during the year, and it should be reflected in your final compensation alongside any outstanding wage and hour claims.

Non-Compete Agreements

Pay close attention to any restrictive clauses in your severance agreement. These agreements often contain non-compete or non-solicitation clauses that can seriously limit your future job options. While California has strong laws limiting the enforceability of non-competes, employers may still include them. You can negotiate to have these clauses removed entirely or, at the very least, narrowed in scope, duration, and geographic reach. Protecting your ability to work in your field without restriction is one of the most important things you can do for your future career. An employment law expert can help you understand the specific language in your agreement.

Professional References

How your former employer talks about your departure can impact your job search. Instead of leaving this to chance, you can negotiate the terms of your professional reference. Ask for a mutually agreed-upon, positive letter of reference or a neutral statement confirming your dates of employment and title. You can also specify who at the company will handle reference checks to ensure the information provided is consistent and professional. This small step helps you control the narrative around your exit and present yourself in the best possible light to future employers, protecting you from potential retaliation.

Career Transition Services

Ask your employer to invest in your future by providing outplacement or career transition services. These services, offered by third-party firms, can provide invaluable support like career coaching, resume writing assistance, and networking guidance. This is a non-cash benefit that is often easier for a company to approve than a direct pay increase. It shows that the company is parting with you on good terms and is committed to your future success. Getting professional help to find a new job can shorten your search time and help you land a role that’s an even better fit.

Create Your Negotiation Strategy

Once you’ve done your homework and know what your severance package is worth, it’s time to build your negotiation plan. Approaching this conversation with a clear strategy is the best way to get what you deserve without burning bridges. This isn’t about being confrontational; it’s about communicating your needs clearly and working toward a fair outcome. A well-thought-out approach shows you’re serious and professional, making it more likely your employer will listen and respond constructively. Think of it as a business discussion where you are advocating for your final terms of employment.

Prepare Your Counter-Offer

Instead of just saying you want “more,” prepare a specific, written counter-offer. This is your chance to clearly state what you’re asking for and, more importantly, why you deserve it. Draft a calm and professional letter or email outlining the changes you want. For example, if you’re asking for more severance pay, tie it to your years of service, key accomplishments, or industry standards. Being concrete makes your request feel less like a demand and more like a reasonable proposal. A strong counter-offer can set the stage for a productive conversation and may help you avoid a potential wrongful termination dispute down the line.

Focus on Mutual Benefits

The most successful negotiations are the ones where both sides feel like they’ve won. Frame your requests as solutions that benefit both you and the company. For instance, you could suggest that extending your health coverage for a few months will give you peace of mind while you search for a new job, which in turn reflects well on the company’s reputation as a caring employer. Or, you could offer to sign a non-disparagement clause in exchange for a positive professional reference. By showing your employer how your requests can help them, you shift the dynamic from a conflict to a collaboration.

Document Everything

In any negotiation, verbal promises are not enough. Get every detail of your agreement in writing. If you have a phone call or meeting with HR, send a follow-up email summarizing what was discussed and agreed upon. This creates a written record and helps prevent misunderstandings later. Remember, the only thing that legally matters is the final, signed severance agreement. Before you sign, read it carefully to ensure it includes every single term you negotiated, from the exact severance amount to the last day of your health coverage. Vague promises won’t hold up, so make sure the final document is crystal clear.

Consider Non-Financial Perks

Severance isn’t just about the cash payment. Companies are often more flexible on non-monetary benefits because they don’t always have a direct impact on their budget. Think about what else could help you transition to your next role. This could include an extension of your health insurance benefits, which is especially important if you need to maintain continuous coverage under family and medical leave provisions. You could also ask for outplacement services to help with your job search, a positive letter of reference, or the ability to keep your company laptop. Don’t underestimate the value of these perks—they can provide significant financial and professional support.

Stay Professional

It’s completely normal to feel emotional when your job ends, but it’s crucial to keep those feelings out of the negotiation room. Maintain a calm, polite, and professional tone throughout the entire process. Getting angry or making threats will only put your employer on the defensive and shut down the conversation. Stick to the facts, focus on your contributions to the company, and present your requests as solutions-oriented proposals. Your goal is to finalize a fair agreement and leave on good terms. Preserving your professional reputation is a long-term asset that is just as valuable as any severance payment.

When to Call an Employment Lawyer

While you can certainly negotiate a severance package on your own, there are times when bringing in a professional is the smartest move you can make. A severance agreement is a legally binding contract, and you can bet your former employer had their lawyers draft it to protect their own interests. Having an experienced attorney on your side helps level the playing field and ensures your rights are protected throughout the process. Think of it as an investment in your future. An employment lawyer does more than just read the document; they analyze it within the context of your employment history and California law. They can help you understand the fine print, identify potential red flags, and assess whether the offer is fair given your specific circumstances, like your tenure and reason for departure. This is especially critical if you believe your termination was unlawful or if the agreement contains complex clauses that could limit your future career opportunities. Consulting with a legal professional isn’t a sign of weakness—it’s a strategic step that gives you the clarity and confidence to secure the best possible outcome. They can be your advocate, negotiator, and guide during a challenging transition.

Why You Should Seek Legal Help

It’s easy to feel pressured to sign a severance agreement quickly, but these documents often contain clauses that can have long-term consequences. An employment lawyer can help you identify restrictive terms, such as non-compete or non-solicitation agreements, that could hinder your ability to find a new job in your field. They can also evaluate whether you might have grounds for a wrongful termination claim. If you suspect your layoff was related to discrimination, harassment, or retaliation, getting legal advice is not just a good idea—it’s essential for protecting your rights and ensuring you are fairly compensated for what you’ve been through.

Understand the “Release of Claims”

One of the most critical parts of any severance agreement is the “release of claims.” By signing this, you are typically giving up your right to sue your former employer for any past issues. This means you forfeit your ability to pursue legal action for things like unpaid overtime, discrimination, or any other potential claims that may have occurred during your employment. An attorney can carefully review this section to make sure you fully understand what rights you are signing away. They will help you determine if the compensation offered is adequate in exchange for this release, especially if you have valid wage and hour claims.

Get Help Reviewing Complex Terms

Severance agreements are filled with dense legal language that can be confusing for anyone without a law degree. Terms like “confidentiality,” “non-disparagement,” and “indemnification” have specific legal meanings that can impact you for years to come. An experienced employment lawyer can translate this jargon into plain English, explaining exactly what you are agreeing to. They will ensure the terms are reasonable and not overly broad, giving you a clear picture of your obligations and protecting you from hidden pitfalls that could cause problems down the road. This step alone can save you from future headaches and legal troubles.

Clarify the Tax Implications

How your severance pay is structured can have a major impact on your finances. A lump-sum payment might seem appealing, but it could push you into a higher tax bracket for the year, resulting in a larger-than-expected tax bill. Alternatively, receiving payments over time as salary continuation can help spread out the tax burden. While you should always consult a tax professional for specific financial advice, an employment lawyer can often negotiate the structure of the payout to be more tax-efficient. They understand the nuances of these agreements and can advocate for a payment plan that works best for your financial situation, ensuring you keep as much of your hard-earned money as possible.

Protect Your Rights

When you’re negotiating a severance package, you’re doing more than just asking for a better deal—you’re ensuring your separation from the company is fair and lawful. This is your opportunity to stand up for yourself and make sure all loose ends are tied up correctly. It’s easy to feel rushed or pressured, but taking a step back to protect your legal rights is one of the most important things you can do. This means looking closely at the circumstances of your departure, accounting for every dollar you’re owed, and carefully reviewing any document before you sign it. Think of this as your final, critical project with your former employer, and the goal is to secure a just and equitable exit.

Consider Potential Discrimination

Take a moment to reflect on the circumstances of your layoff. Does anything feel off? While companies can conduct layoffs for business reasons, they cannot use them as a cover for illegal actions. If you suspect your termination was influenced by your age, gender, race, disability, or another protected characteristic, you may have grounds for a discrimination claim. Proving this can be more challenging during a large-scale layoff, but if you have evidence that you were unfairly targeted, it can provide significant leverage in your negotiation. Document any comments, patterns, or performance reviews that support your feeling that the layoff was not based on performance or business needs alone.

Address Unpaid Wage and Hour Claims

Your severance pay is separate from the wages you’ve already earned. Before you sign anything, make sure your final paycheck includes all compensation you are legally owed. In California, this includes your regular pay, any accrued and unused vacation time, and payment for any missed meal or rest breaks. It’s also crucial to verify that you’ve been compensated for all hours worked, including any overtime. If you have outstanding wage and hour claims, now is the time to address them. Don’t let these earned wages get overlooked in the severance discussion; they are your money, not a negotiation chip.

Use Your Review Period

Never sign a severance agreement on the spot. You should be given a reasonable amount of time to review the document—in some cases, the law requires it. Use this period wisely. Rushing the process can lead you to give up important rights or accept terms that aren’t in your best interest. This is your chance to read every line, understand what you’re agreeing to, and seek professional advice. An employment lawyer can help you identify red flags and understand the full implications of the agreement, giving you the clarity and confidence you need to proceed.

Finalize All Documentation

Verbal promises are not legally binding. Once you’ve reached an agreement on your severance terms, insist that every single detail is put in writing. The final document should clearly outline the payment amount, benefits continuation, and any other negotiated perks. Review this final agreement carefully one last time. Look for hidden clauses, like restrictive non-compete agreements or a broad “release of claims” that prevents you from pursuing legal action for issues like wrongful termination. Having a clear, comprehensive written agreement ensures there are no misunderstandings and that your former employer is held to their word.

Avoid These Common Mistakes

Navigating a severance negotiation can feel like walking through a minefield, but knowing what not to do is just as important as knowing what to do. Many people leave money and benefits on the table simply by making a few common missteps. By being aware of these potential pitfalls, you can approach your negotiation with more confidence and secure a package that truly supports your transition to the next chapter of your career. Let’s walk through the most frequent mistakes and how you can steer clear of them.

Accepting the First Offer

Think of your employer’s first severance offer as a starting point, not a final destination. Companies often expect you to negotiate and may even build a little wiggle room into their initial proposal. Accepting it right away could mean missing out on a much better deal. Before you agree to anything, take the time to assess the offer against your contributions to the company, your financial needs, and industry standards. If you believe you were subject to wrongful termination, you may have even more leverage. Don’t be afraid to present a thoughtful counter-offer that reflects your true value.

Making Decisions Based on Emotion

Losing a job is incredibly stressful, and it’s easy to let feelings of anger, fear, or panic take the wheel. However, making decisions from an emotional place can be costly. Signing an agreement out of desperation or refusing to negotiate out of spite can work against your best interests. It’s crucial to take a step back, breathe, and approach the situation with a clear head. This is where an outside perspective can be invaluable. Talking it over with a trusted advisor or an attorney from our firm can help you separate the emotion from the business decision at hand, ensuring you act strategically.

Overlooking Important Clauses

A severance agreement is more than just a dollar amount; it’s a binding legal contract filled with clauses that can impact your future. Pay close attention to the fine print. Many agreements include non-compete, non-solicitation, or non-disparagement clauses that can limit your future job prospects or your ability to speak about your experience. Another critical component is the “release of claims,” where you agree not to sue the company for any past issues. Understanding the full scope of what you’re signing is essential. If the legal language feels overwhelming, it’s a good idea to have an employment law expert review it with you.

Rushing the Process

Your employer might create a sense of urgency, but you are under no obligation to sign a severance agreement on the spot. In California, if you are over 40, you are legally entitled to at least 21 days to consider the offer and another seven days to revoke your signature after signing. Use this time wisely. Rushing the process is a mistake that can lead to regret. Let the company make the first move, and then use your review period to do your research, calculate what you’re owed, and seek legal advice if needed. A decision this important deserves careful consideration, not a hasty signature.

Forgetting Key Benefits

Severance isn’t just about the cash payout. A comprehensive package can include a wide range of valuable benefits that can ease your transition. Don’t forget to negotiate for things like extended health insurance coverage (COBRA), payment for unused vacation time, stock options, and pro-rated bonuses. You can also ask for non-financial perks like positive professional references or outplacement services to help you find your next role. Think holistically about what you need. Sometimes, a few extra months of health coverage can be more valuable than a slightly higher cash payment, especially when considering all your potential wage and hour claims.

Finalize Your Agreement

Once you’ve reached a verbal agreement, the final step is to make it official. This stage is all about details and documentation. It’s where you ensure every negotiated point is clearly recorded and understood by both you and your former employer. Rushing through this part can undo all your hard work, so take your time to carefully review every document before you sign. This ensures there are no surprises later and that you have a clear path forward as you transition to your next opportunity.

Confirm the Payment Structure

Your severance pay can be delivered in a few different ways, and it’s important to understand which method works best for you. The most common options are a single lump-sum payment or salary continuation, where you receive regular paychecks for a set period. A lump sum gives you all the money at once, which can be great for immediate financial security. However, salary continuation might allow you to keep your benefits for longer. Each option has different tax implications, so make sure you clarify the exact payment schedule and how it will affect your finances before you agree.

Clarify How Benefits Will Be Handled

Your compensation is more than just your salary. The final agreement should explicitly state what happens to your other benefits. This includes payment for any unused vacation or sick days you’ve accrued. It’s also crucial to discuss health insurance continuation through COBRA and how long the company will contribute to the premiums. If you have stock options or a 401(k), the agreement should detail vesting schedules and rollover procedures. Don’t leave these details to chance; get clear, written confirmation on how every benefit will be handled after your last day.

Get Everything in Writing

A verbal agreement isn’t enough. Every single term you’ve negotiated must be documented in the final severance agreement. This written contract is the only thing that legally matters, so review it carefully to ensure it reflects your entire discussion. If a promise was made during negotiations but isn’t in the document, it’s not enforceable. If you’re dealing with a potential wrongful termination, having a lawyer review the final paperwork is a critical step to protect your rights and ensure the language is fair and unambiguous.

Plan Your Next Steps

With a signed agreement in hand, you can start planning for what’s next. First, ask HR for a breakdown of your final payout so you know exactly how much you’ll receive after taxes. This is essential for creating a realistic budget for the coming months. Since your income will likely change, it’s a good idea to reassess your spending and set aside funds for an emergency. This financial planning provides a safety net, giving you the peace of mind to focus on finding your next career move without added financial stress.

Related Articles

- Why You Need a Severance Negotiation Attorney

- Canoga Park Employment Lawyer – Bluestone Law

- Constructive Dismissal California: A Complete Guide

Frequently Asked Questions

Is my employer legally required to offer me a severance package? Generally, no. In California, there’s no law that forces a company to provide severance pay. It’s typically offered as a courtesy and in exchange for you signing an agreement that releases the company from future legal claims. The main exception is if your employment contract or an established company policy explicitly promises severance. Otherwise, it’s a benefit the company chooses to offer, which is why it’s almost always open to negotiation.

What if my employer won’t negotiate their initial offer? It can be discouraging if your employer seems firm, but you still have options. First, make sure you’ve presented a calm, fact-based case for your counter-offer. If they still refuse to budge on the payment amount, consider shifting your focus to non-financial benefits like extended health coverage or career services, which can be easier for them to approve. If you feel the offer is truly unfair or believe your termination was unlawful, this is a key moment to consult with an employment lawyer to understand your full range of options.

I’m worried about the cost. Is it really worth hiring a lawyer to review my agreement? This is a very practical concern. Think of legal counsel as an investment in your future. An attorney can often identify ways to improve your package that more than cover their fee, whether by increasing the payout or removing a restrictive clause that could limit your future earnings. More importantly, they provide peace of mind by ensuring you aren’t signing away important rights without fair compensation, especially if you suspect your termination was wrongful.

How long do I have to decide whether to accept the offer? You should never feel pressured to sign immediately. Federal law provides employees over 40 with at least 21 days to review a severance agreement. While there isn’t a specific legal timeline for younger employees in California, you should always be given a reasonable period to consider the offer. If you feel rushed, it’s perfectly acceptable to politely request more time to review the document thoroughly and seek advice.

Besides more money, what’s one of the most valuable things I can negotiate for? Continued health insurance coverage is one of the most valuable non-cash benefits you can secure. Losing your job often means losing your health plan, and paying for COBRA out-of-pocket can be incredibly expensive. Asking your former employer to cover your COBRA premiums for a few months can provide a significant financial cushion and invaluable peace of mind for you and your family while you search for a new position.